Why Mortgage Lenders in Omaha Are Trick to Obtaining the very best Deal

Why Mortgage Lenders in Omaha Are Trick to Obtaining the very best Deal

Blog Article

Find the Perfect Mortgage Broker for Your Mortgage Requirements

Choosing the appropriate home loan broker is a vital action in the mortgage process, as the know-how and resources they provide can considerably influence your monetary outcome. It is vital to take into consideration different factors, including their market experience, access to a range of loan providers, and the clearness of their interaction. Additionally, comprehending their fee framework and services can help you make an educated choice. Nonetheless, knowing where to begin in this search can usually be frustrating, increasing the question of what particular high qualities and credentials absolutely set a broker apart in an open market.

Understanding Home Mortgage Brokers

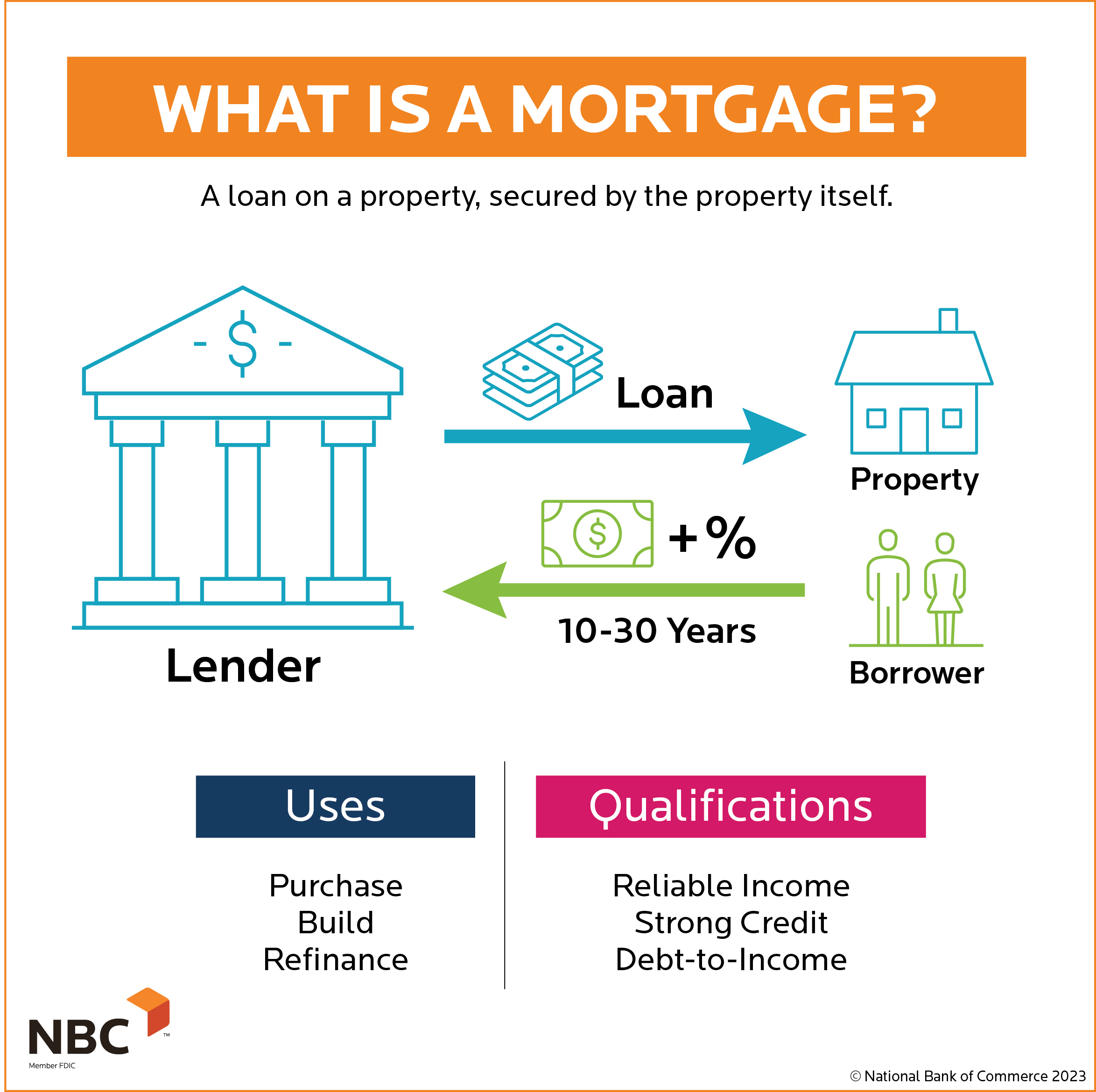

Understanding home mortgage brokers is essential for navigating the intricacies of home financing. Mortgage brokers function as middlemans between debtors and lenders, assisting in the process of securing a home mortgage. They have substantial understanding of the financing landscape and are competent at matching clients with ideal finance products based upon their financial profiles.

A crucial function of mortgage brokers is to analyze a debtor's financial circumstance, consisting of debt scores, earnings, and debt-to-income ratios. This examination allows them to recommend home mortgage choices that align with the borrower's capabilities and needs. Furthermore, brokers have accessibility to a range of loan providers, which enables them to existing numerous funding alternatives, potentially resulting in extra favorable terms and rates.

By utilizing a home loan broker, consumers can save time and decrease anxiety, making sure a much more efficient and informed home financing experience. Understanding the role and benefits of mortgage brokers inevitably encourages property buyers to make enlightened decisions throughout their home loan journey.

Key Top Qualities to Search For

When choosing a home loan broker, there are a number of essential top qualities that can dramatically impact your home funding experience. Look for a broker with a strong track record and favorable client reviews. A broker with pleased customers is most likely to offer reliable solution and audio guidance.

A broker with considerable industry understanding will certainly be much better outfitted to navigate complex home loan choices and supply customized remedies. A broker that can plainly explain terms and processes will guarantee you are knowledgeable throughout your mortgage trip.

An additional important top quality is openness. A trustworthy broker will freely go over charges, potential conflicts of passion, and the whole loaning process, enabling you to make informed decisions. Search for a broker that shows solid negotiation skills, as they can protect far better terms and rates on your behalf.

Last but not least, consider their schedule and responsiveness. A broker who prioritizes your demands and is easily accessible will certainly make your experience smoother and much less demanding. By examining these essential qualities, you will be better positioned to discover a mortgage broker who straightens with your mortgage needs.

Inquiries to Ask Prospective Brokers

Selecting go to this site the ideal mortgage broker involves not only determining vital qualities but additionally involving them with the best questions to assess their know-how and fit for your requirements. Begin by asking about their experience in the industry and the kinds of lendings they concentrate on. This will assist you recognize if they line up with your certain financial circumstance and goals.

Inquire you can try these out concerning their procedure for analyzing your financial health and wellness and determining the most effective home mortgage options. This inquiry discloses exactly how comprehensive they are in their method. In addition, inquire about the series of loan providers they collaborate with; a broker who has access to several lenders can supply you much more competitive prices and options.

Recognizing exactly how they are made up-- whether through ahead of time charges or commissions-- will certainly provide you insight right into prospective conflicts of passion. By asking these targeted questions, you can make a much more educated choice and discover a broker who finest suits your home funding needs.

Researching Broker Qualifications

Extensively looking into broker credentials is a vital action in the mortgage selection process. Guaranteeing that a home loan broker has the suitable qualifications and licenses can dramatically influence your home funding experience.

Additionally, exploring the broker's experience can give understanding into their knowledge. A broker with a tried and tested track document in efficiently shutting finances similar to your own is indispensable.

Furthermore, investigate any type of disciplinary activities or grievances lodged versus the broker. On-line reviews and testimonies can use a peek into the experiences of previous customers, assisting you analyze the broker's track record. Inevitably, comprehensive research into broker credentials will encourage you to make a notified choice, promoting self-confidence in your mortgage procedure and enhancing your overall home getting experience.

Assessing Fees and Providers

Examining services and charges is commonly a vital component of choosing the best home loan broker. Openness in charge structures enables you to contrast brokers efficiently and evaluate the overall price of obtaining a mortgage.

In addition to fees, take into consideration the variety of solutions used by each broker. Some brokers provide a thorough suite of services, consisting of monetary assessment, assistance with paperwork, and continuous assistance throughout the funding procedure.

When examining a broker, inquire concerning their responsiveness, availability, and willingness to address inquiries. A broker that focuses on customer service can make a considerable difference in navigating the complexities of mortgage applications. Ultimately, recognizing both services and charges will equip you to select a home mortgage broker that straightens with your economic needs and assumptions, making sure a smooth course to homeownership.

Verdict

In verdict, choosing an appropriate mortgage broker is important for accomplishing desirable funding terms and a streamlined application procedure. Inevitably, a educated and trustworthy home loan broker serves as an important ally in browsing the complexities of the mortgage landscape.

Selecting the best home loan broker is a vital step in the home finance process, as the experience useful content and sources they give can dramatically impact your financial outcome. Home mortgage brokers offer as intermediaries in between lenders and borrowers, assisting in the procedure of securing a home loan. Understanding the duty and benefits of home loan brokers inevitably empowers buyers to make informed choices throughout their mortgage trip.

Making certain that a mortgage broker has the suitable certifications and licenses can significantly impact your home loan experience. Eventually, a reliable and experienced home loan broker serves as a valuable ally in browsing the complexities of the home loan landscape.

Report this page